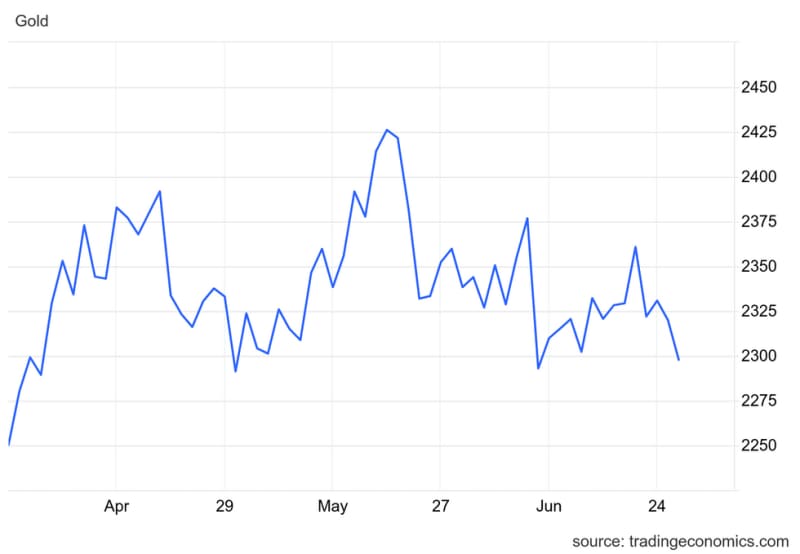

After a record-setting first quarter, the gold price started 2024's second quarter with strong momentum, breaking through US$2,400 per ounce in the middle of April and setting new all-time highs.

At the beginning of April, gold was at US$2,250, finding support from investors betting on a June interest rate cut from the US Federal Reserve, as well as strong central bank buying. The precious metal found further support in May as geopolitical and sovereign debt concerns weighed on investors in China and the Middle East.

On May 20, gold hit US$2,450.05, its highest price ever. Read on for more on how it got there and what's next.

Gold price hits new all-time highs

The biggest story for gold in Q2 was its price activity. As mentioned, strong momentum carried over from March, allowing the yellow metal to break through US$2,400 in mid-April. Its price gains were influenced by various factors, including continued buying from central banks, strong demand from Chinese retail investors and better sentiment from western investors, which helped to stem flows out of gold exchange-traded funds (ETFs).

In a May interview with the Investing News Network (INN), Jeff Clark, editor of Paydirt Prospector, noted several other market dynamics that caused the price of gold to rise so dramatically. He said the real starting point was the end of February, when the Fed indicated it was expecting three or four rate cuts in 2024.

“All of a sudden, gold was off to the races. It jumped so high that all of a sudden you had some short covering that needed to happen then as well. So you had short covering, which means they’re buying. And then you had momentum chasers and traders jumping all in. That was a pretty good spike ... I think's what kind of started all of this,” Clark said.

Chart via Trading Economics.

Gold price, Q2 2024.

Gold's rise in the second quarter also coincided with an improving economic situation in the US. The country's consumer price index cooled slightly in April, buoying expectations for a rate cut from the Fed.

Ultimately a June cut wasn’t in the cards, and since then better personal consumption expenditures and consumer price index data in May and June, along with a strong May jobs report, have sent mixed messages. CME Group's (NASDAQ:CME) FedWatch tool now shows about a 60 percent chance of a cut in September.

This uncertainty has created resistance for gold, which finished Q2 at the US$2,325 level.

Central bank buying still a story for gold

Central banks were strong buyers of gold in Q1, purchasing 289.7 metric tons (MT), in line with numbers from 2022 and 2023. Turkey, China and India led the way, with acquisitions of 30.12 MT, 27.06 MT and 18.51 MT, respectively.

This buying trend continued into the start of the second quarter, with central banks adding 33 MT to their collective reserves in April. Turkey made purchases for the 11th consecutive month, adding 8 MT to its coffers in April, while China saw a drastic reduction, buying just 2 MT, well below its 18 MT average over the past 17 months.

Though complete data for May isn’t available at this time, reports indicate that the People’s Bank of China halted purchases of gold for the first time in 18 months. At the same time, analysts have noted that the Chinese central bank has been making unreported acquisitions of the precious metal for some time now.

There is also speculation that China's central bank will resume buying once gold has eased off of recent highs. As of April, China’s gold reserves stood at 2,265 MT, accounting for 4.9 percent of its foreign exchange holdings.

Looking forward, a central bank survey from the World Gold Council indicates that as a whole the buying spree isn't over, with 29 percent of the 70 respondents saying they plan to continue adding gold to their reserves over the next year.

Gold ETF outflows slow in Q2

Gold ETFs continued to see outflows in the second quarter, albeit at a reduced pace. Outflows from western funds have declined, while funds elsewhere in the world have seen higher inflows.

According to the World Gold Council, the first quarter of the year saw North American and European gold funds lose a combined 122.4 MT from their holdings, while Asian funds added 9.9 MT. So far in the second quarter, combined outflows from North America and Europe have fallen to 47.7 MT, while gains in Asian funds accelerated to 24.2 MT.

As of May 24, the top 10 fund inflows were dominated by Chinese ETFs, which captured four spots, including the top three, and accounted for 18.6 MT of Asian demand. The lead spot went to Huaan Yifu Gold ETF (SHA:518880), whose holdings increased by 7.4 MT. Other Asian funds on the list came from Japan and India, which accounted for 4.3 MT.

US and European funds weren’t left out. Switzerland’s UBS ETF Gold (SWX:AUUSI), the US-based SPDR Gold Shares (NYSE:GLD), the Sprott Physical Gold Trust (NYSE:PHYS) and Ireland's Royal Mint Responsibly Sourced Physical Gold ETC (LSE:RMAU) all recorded inflows during the quarter.

On the flip side, the worst-performing ETFs for the quarter in terms of flows were primarily from Europe, with German and UK funds holding six of the slots, with two Swiss, one French and one American fund rounding out the bottom 10.

When will gold stocks go up?

For the most part, gold stocks haven’t yet reacted to the elevated gold price.

In a June interview with INN, Rick Rule, proprietor at Rule Investment Media, suggested that the disconnect is related to the fact that central banks have been such strong buyers of gold.

"The central banks have been buyers of gold, but they aren't buyers of gold shares. So it makes perfect sense that because the audience for gold, at least temporarily, has changed, that this dichotomy exists," he said.

Newmont (TSX:NGT,NYSE:NEM), the world’s largest gold producer, has seen a modest gain of about 5 percent since the start of the year, while rival Barrick Gold (TSX:ABX,NYSE:GOLD) has fallen by around 4 percent.

That's not to say there haven’t been winners. On the TSX, Galiano Gold (TSX:GAU,NYSEAMERICAN:GAU) is up 88.71 percent gain year-to-date, and G2 Goldfields (TSX:GTWO,OTCQX:GUYGF) has surged 78.67 percent.

When it comes to the juniors, Clark thinks they are ready to take off. He pointed out that the VanEck Junior Gold Miners ETF (ARCA:GDXJ) has outperformed gold since the precious metal took off at the end of February.

Clark also noted that the juniors that aren’t in the GDXJ have been underperforming, but given how well gold has performed it’s just a matter of time. “I think the fuse has been lit, because once gold starts to move the money will move down into the producers, then developers and then juniors,” he said.

Small-cap winners on the TSXV include Adyton Resources (TSXV:ADY,OTC Pink:ADYRF) which has seen an 1,100 percent increase year-to-date, and Black Mammoth Metals (TSXV:BMM,OTC Pink:LQRCF), up 959 percent in that time.

Rob McEwen, founder of Goldcorp and current chairman and chief owner of McEwen Mining (TSX:MUX,NYSE:MUX), told INN in June that he thinks gold stocks are poised for a breakout.

“With the price of gold above US$2,000 an ounce, people are looking at junior explorers and saying, 'What have they found and could that really grow?' You’re watching the high-cost producers suddenly start performing because now they’re moving into the positive territory in their earnings, and there are some M&As still going around as people say it’s faster and possibly cheaper to buy the ounces than to drill and wait for the results,” he said.

Investor takeaway

With the price of gold changing so fast, Clark has had to make some adjustments to his forecast for the rest of the year. For him, the next level to watch is US$2,500, and he is confident it will get there this year.

“We had a 38 percent rise in the gold price, in this upcycle, but the average upcycle is much higher, and if this upcycle were to end today it would be the lowest in history,” Clark said.

David Morgan, publisher of the Morgan Report, also sees gold reaching US$2,500 before the end of 2024.

These predictions are in line with prices from major financial institutions. The Bank of America (NYSE:BAC) sees gold climbing to US$3,000 over the next 12 to 18 months, while JPMorgan (NYSE:JPM) sees US$2,500 by the year's end.

Overall, experts believe a great deal of potential has yet to be unlocked in the gold price as well as gold companies. The current market may provide opportunities for investors who have been waiting on the sidelines to invest in producers or ETFs, and — depending on risk appetite — chances to get exposure to well-positioned juniors.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.